How we calculate annual spending from our endowed funds

May 28, 2021

| By Jamie Schloegel, Chief Executive Officer |

Deciding how much to spend each year

Donors and nonprofit representatives ask me all the time how grant spending from our funds actually works. Our soon to be released 2020 annual impact report will show net assets of $57,979,530, yet total annual grantmaking of $4,318,863. A common question is why don’t we spend more, especially in years of great need? It is a fair question, and the answer begins with understanding the mechanism of a fund that donors create to last forever, and the legislation that governs prudent management of such kinds of charitable funds.

Honoring donors’ wishes for a lasting gift

When a fund is created by one or more gifts to last forever it does so through the mechanism of an endowment. Endowments have two main objectives: keeping pace with inflation and making grants to support the fund’s purpose each year forever. Both of these goals require the fund to be invested. The finance and investment committee of our board of directors, advised by our investment manager Trust Point, is responsible for our investment choices and policies.

Understanding government regulations of endowment funds

These policies must be enacted under the guidance provided in the Uniform Prudent Management of Institutional Fund Act (UPMIFA) which Wisconsin adopted in 2009. This legislation is what governs endowment spending and modifications as well as investments. UPMIFA says that donor intent is key. If a donor restricted a gift to be endowed, it is our responsibility under UPMIFA guidance to administer the gift prudently to last forever to fulfill its charitable purpose.

Keeping up with inflation is critical to ensuring gifts last forever. We also want to maximize the amount of grants available from each fund each year since supporting nonprofits or making scholarships is the whole reason a charitable fund is created. Our finance and investment committee evaluates these factors each year and has historically allocated 4 to 5% of each fund’s balance as the amount available for grantmaking annually.

Recent changes to our spending policy on endowment funds

Last year our board approved a slight update to our spending policy in an effort to smooth out the effects of market volatility on the annual spending calculation. This will provide a more predictable flow of distributions for fund holders and beneficiaries year over year. The new spending policy protocol applies the annually approved spend rate (4—5%) to the average market value of each fund on December 31 over the proceeding 12 quarters (or less in the case of newer funds); our previous spending policy calculation only used the most recent December 31 balance.

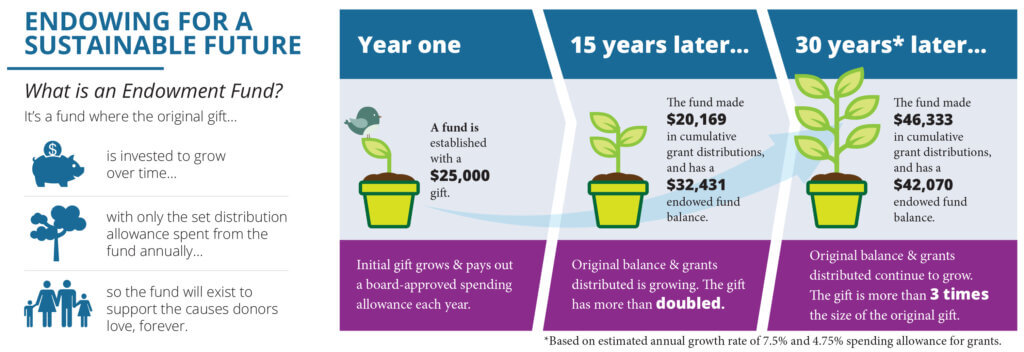

Picturing endowment growth over time

Here is an example of the power of an endowment. A fund established with one $25,000 gift can grow exponentially assuming a 4.75% annual spending rate and an average 7.5% rate of return. By year 15, the gift’s value could grow to more than $32,000 and will have granted $20,169. By year 30, those numbers grow to a $42,000 fund balance and over $46,000 in total grants — all from ONE original gift of $25,000. And the fund will keep growing and granting into the future forever.

Honoring our fiduciary responsibilities

Stewardship of the assets entrusted to us is one of our most important responsibilities. Keeping pace with inflation makes each permanent fund as effective 50 years from now as it is today, in turn ensuring we continue to honor our donors’ original intent. For Good. Forever.

You can find additional information on UPMIFA and resources on LCF’s spending policy for its permanent funds below:

WI STATE LEGISLATURE: 112.11 UPMIFA